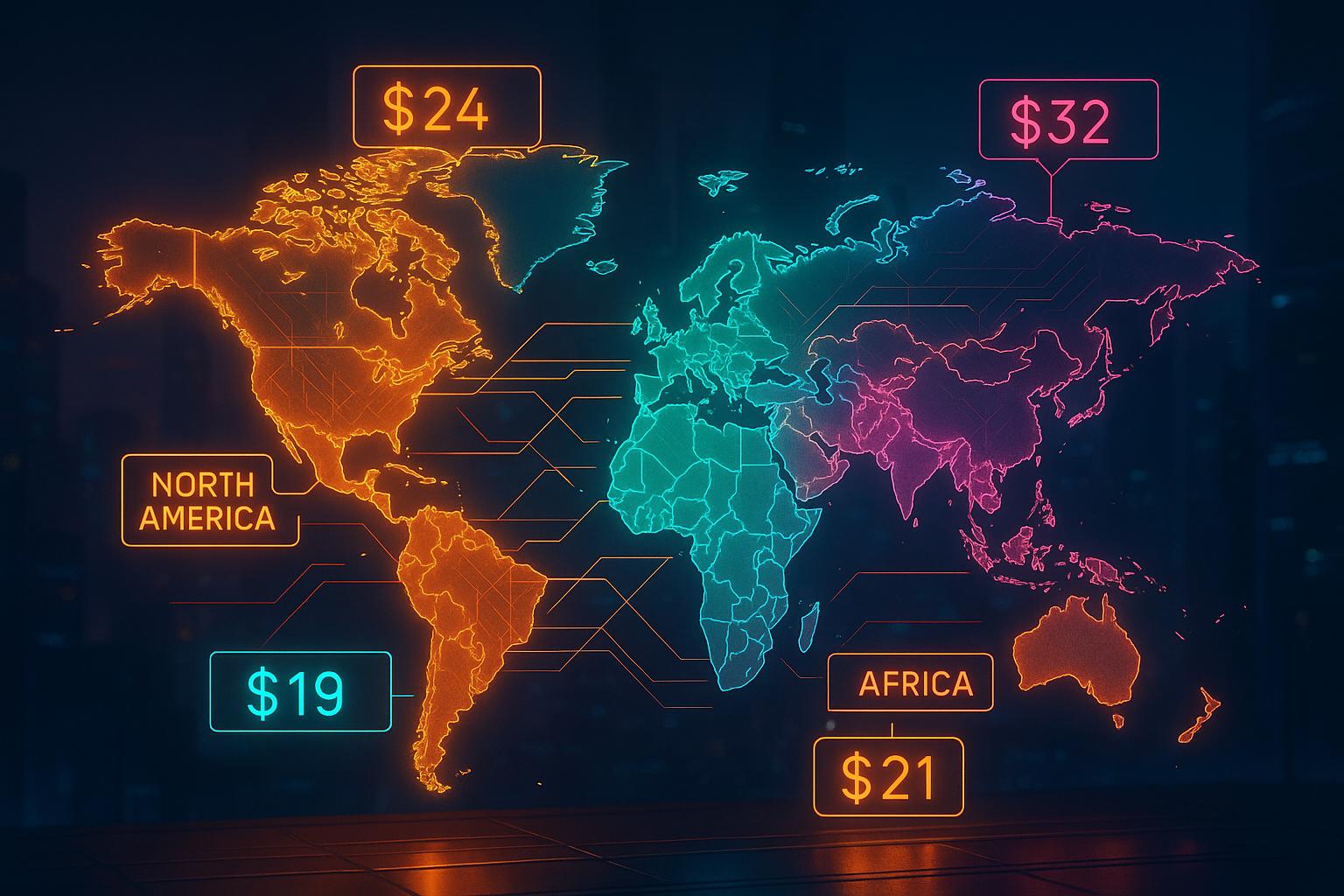

IPv4 prices depend heavily on location. Just like real estate, demand, supply, and regional policies drive costs. Here’s a quick breakdown:

- North America (ARIN): High demand from cloud providers and ISPs keeps prices elevated. Leasing costs range from $0.50–$0.70 per month, with purchasing costs around $32–$34 per IP.

- Europe (RIPE NCC): Balanced market with flexible policies. Leasing costs $0.45–$0.65 per month, and stable pricing makes it a strong choice for businesses.

- Asia-Pacific (APNIC): The most expensive region due to limited supply and strict regulations. Leasing costs peak at $0.83 per month, while purchasing prices range $30–$35 per IP.

- Africa (AFRINIC): The most affordable region, with leasing costs between $0.30–$0.45 per month. However, strict policies and limited inter-regional transfers create challenges.

Быстрое сравнение

| Регион | Monthly Lease Cost | Purchase Cost (/IP) | Key Features |

|---|---|---|---|

| Северная АмерикаСеверная Америка | $0.50–$0.70 | $32–$34 | High demand, flexible market |

| Европа | $0.45–$0.65 | $32–$34 | Steady prices, easy transfers |

| Азиатско-ТихоокеанскийАзиатско-Тихоокеанский | $0.60–$0.83 | $30–$35 | High costs, strict policies |

| АфрикаАфрика | $0.30–$0.45 | $30–$35 | Low costs, no inter-regional transfers |

Key takeaway: Prices and policies vary widely by region. Businesses should consider location-based strategies to optimize costs, balance short-term leasing with long-term purchasing, and plan for IPv6 adoption.

1. North America (ARIN)

The IPv4 market in North America, governed by ARIN, is well-established and highly competitive. This is largely driven by the demands of cloud providers and broadband expansion, which has resulted in higher pricing for IPv4 addresses.

In March 2025, the average price for /16 blocks dropped significantly, going from nearly $50.00 per address in mid-2024 to just over $24.00. Meanwhile, smaller blocks, such as /20–/21 and /22–/24, stayed steady at $31.00–$34.00 per address. On the leasing side, prices climbed from $0.41 per IP address in January 2024 to $0.47 by December, reflecting the continued need for flexible, short-term solutions among businesses.

Regulatory Environment and Market Access

These pricing changes highlight ARIN’s adaptable regulatory framework. ARIN’s policies encourage liquidity by allowing full monetization of IP addresses, making it easier for holders to buy, sell, or lease their allocations.

"Over 95% of IP addresses in the IPXO Marketplace come from RIPE NCC and ARIN due to these registries’ more lenient sustainability policies that fully allow IP monetization" – Paulius Judickas, VP of Strategic Alliances at IPXO

This approach has positioned ARIN, alongside RIPE NCC, as a leading source of tradeable IPv4 addresses. The robust secondary market in the region ensures smoother transactions and more predictable pricing trends.

Demand Drivers and Market Dynamics

Several factors are fueling IPv4 demand in North America. For instance, the Broadband Equity, Access, and Deployment (BEAD) Program is expected to intensify demand, especially in rural areas, as it aims to expand broadband access. However, delays in the program have created uncertainty, potentially slowing down investment timelines for ISPs.

Additionally, artificial intelligence companies are becoming major players in the market. With the growth of AI infrastructure, these companies require large IP address allocations to support data collection and processing. As Paulius Judickas notes:

"AI is influencing the market, and more requests are coming from AI companies to collect data" – Paulius Judickas, VP of Strategic Alliances at IPXO

By May 2025, over 18 million IPv4 addresses had already been transferred, setting the stage for a potential record of 37 million transfers by year-end – a level not seen in seven years. However, the available supply is shrinking, with just 18.6 million addresses remaining by the end of Q3 2024, compared to 44.8 million in 2015.

This interplay between regulatory policies and regional demand underscores how these factors shape the valuation of IPv4 assets.

Business Opportunities and Strategic Considerations

Large buyers, including hyperscalers, are taking advantage of reduced demand from smaller ISPs to negotiate better deals. For companies holding unused IPv4 addresses, the opportunity to monetize these assets remains strong. This is especially true given the ongoing demand from AI companies, cloud providers, and broadband initiatives.

Leasing has also become an appealing option for businesses with short-term needs or those wanting to test the waters before committing to permanent purchases. The leasing market offers more stability and flexibility compared to the often-volatile purchase market.

V4 Capital PartnersПартнер V4 Capital provides tailored brokerage, investment guidance, and consulting services to help businesses navigate these market complexities in North America.

The dynamics in North America offer a clear example of how regional factors influence IPv4 pricing and market behavior worldwide.

2. Europe (RIPE NCC)

Europe’s IPv4 market, managed by RIPE NCC, stands out for its steady and predictable nature, offering a contrast to the fast-paced North American market. In 2024, the region maintained an average price of $0.43 per IP address, with minimal changes over time.

Policy Framework and Market Liquidity

RIPE NCC’s flexible transfer and leasing policies have created one of the busiest IPv4 markets globally. Unlike regions with stricter requirements, RIPE NCC has eliminated the need for justification when acquiring IPv4 space, simplifying transactions and boosting activity.

"Over 95% of IP addresses in the IPXO Marketplace come from RIPE NCC and ARIN due to these registries’ policies that facilitate full monetization of resources." – Paulius Judickas, VP of Strategic Alliances at IPXO

The numbers speak for themselves. In 2024, the European market saw 6,204 intra-RIR transfers, involving a total of 17 million addresses. Even in just one month – March 2025 – 1.4 million IPv4 addresses changed hands within the RIPE NCC region. This level of activity highlights the market’s maturity and stability, which are key factors influencing value.

Pricing Dynamics and Market Characteristics

European IPv4 pricing remains consistent across various block sizes. For example, during Q1 2025, /24 blocks were priced between €12 and €15 (around $12.84 to $16.05), while leasing costs ranged from $0.45 to $0.65 per month per IP address. Leasing has gained popularity as businesses increasingly prefer flexible rental options over outright purchases.

Demand Drivers and Industry Applications

Demand for IPv4 addresses in Europe is fueled by industries like finance, e-commerce, and technology. This steady demand helps keep pricing stable and prevents extreme market fluctuations. Additionally, compliance with GDPR’s data localization requirements has a direct impact on trading practices and the regional distribution of IPv4 resources. Security measures are also a significant factor, with 72% of IPv4 space in the region now safeguarded by Route Origin Authorizations (RPKI), enhancing the overall value of these assets.

Strategic Market Position

RIPE NCC enforces selective transfer policies, limiting inter-RIR transfers to ARIN, APNIC, and LACNIC. These measures help maintain market integrity and liquidity. Over the years, the European market has transitioned from addressing IPv4 shortages to optimizing resources. IPv4 addresses are now seen as strategic assets, reflecting a more sophisticated approach to their management.

For organizations holding unused IPv4 allocations in Europe, the stable pricing environment and active transfer market present excellent opportunities to monetize these assets. Partnering with experienced brokers like V4 Capital PartnersПартнер V4 Capital can help maximize the value of underutilized IPv4 resources and ensure a smooth transaction process.

3. Asia-Pacific (APNIC)

The Asia-Pacific region stands out as one of the priciest and most supply-constrained IPv4 markets. By May 2024, APNIC saw premium rates climb to $0.83 per IP address, driven by rapid digital growth in the region.

Policy-Driven Scarcity and Market Dynamics

Strict policies within APNIC significantly limit IPv4 monetization opportunities, restricting them mainly to legacy space holders. Unlike RIPE NCC’s more lenient framework, APNIC’s rules discourage many companies from leasing or selling their IPv4 resources. Instead, businesses often keep their IPs active by marking them as "in use."

"Meanwhile, APNIC commanded premium rates (peaking at $0.83 in May) due to severe supply constraints – despite growing demand in the Asia-Pacific region, registry policies effectively prohibit most organizations from monetizing their resources, with the exception of legacy space. This has created a situation where companies in APNIC regions often announce IPs just to keep them marked as ‘in use’ rather than monetizing them through leasing." – Paulius Judickas, VP of Strategic Alliances at IPXO

As of 2024, APNIC managed 3.6 million available IPv4 addresses, accounting for around 78% of the total 4.6 million IPv4 addresses available across all regional registries.

Regional Demand Drivers and Market Characteristics

The region’s IPv4 market is shaped by a combination of policy restrictions and surging demand. Rapid internet adoption in countries like China, India, and Japan, along with the rise of IoT devices and dense populations, has fueled this demand. To cope with IPv4 shortages, many Internet Service Providers (ISPs) rely on Carrier-Grade NAT (CGNAT), which adds complexity to IP address management. Additionally, the slow transition to IPv6 keeps IPv4 in high demand.

Pricing Trends and Market Evolution

APNIC was the first Regional Internet Registry (RIR) to deplete its IPv4 supply back in 2011. Today, outright purchases in the region are estimated at $30–$35 per IP, while leasing rates have reached record highs, with utilization rates exceeding 81% as 2025 approaches. In more developed markets like Japan and Australia, leasing has become increasingly popular as purchasing costs remain steep.

Strategic Considerations for Organizations

For organizations holding unused IPv4 allocations, the current premium market offers an opportunity to monetize these assets. However, they should act with urgency, as future policy changes could limit transfer options – similar to trends seen in North America and Europe. Businesses in the APNIC region with underutilized IPv4 resources may benefit from partnering with experienced brokers like V4 Capital PartnersПартнер V4 Capital to navigate regulatory complexities and maximize asset value.

4. Africa (AFRINIC)

Africa’s IPv4 market reflects a mix of affordability, limited resources, and strict regulations, shaped by the continent’s unique demographic and infrastructure challenges. While AFRINIC offers some of the lowest IPv4 leasing rates globally, growing demand and limited availability are reshaping the market landscape.

Competitive Pricing Amid Tightening Supply

As of 2024, IPv4 leasing in the AFRINIC region averages $0.42 per IP address – lower than the global average of $0.50 per address. For outright purchases, large IPv4 blocks are priced between $30 and $35. While these prices have historically been driven by lower demand, the situation is changing. AFRINIC is nearing the depletion of its IPv4 resources allocated by IANA, and new allocations are now restricted to subnet ranges between /24 and /22. To acquire these resources, organizations face fees of $1,200 for a /22 allocation and $1,000 for allocations ranging from /24 to /23.

Policy Landscape and Transfer Restrictions

AFRINIC enforces a strict policy framework centered on principles like registration, conservation, and efficient use. Organizations must justify their IPv4 allocations based on immediate needs, ensuring that resources are used efficiently. Unlike other regions, AFRINIC prohibits inter-RIR transfers, meaning IPv4 resources allocated here are exclusively for use within Africa. This policy creates distinct regional dynamics and limits the redistribution of IPv4 addresses across borders.

Demographic Challenges and Allocation Disparities

Africa faces a tough balancing act in managing its IPv4 resources. With less than 6% of global IPv4 addresses, AFRINIC has allocated over 115 million addresses to its members, leaving just 1.29 million remaining. However, allocation is uneven across the continent. Egypt and South Africa lead in total IPv4 allocations, while regions like Central Africa have the lowest per capita availability.

| Регион | Population | IPv4 Addresses | Ratio (IPv4:Population) |

|---|---|---|---|

| Northern Africa | 270,974,041 | 51,439,360 | 5.3:1 |

| Southern Africa | 187,922,561 | 28,000,512 | 6.7:1 |

| Eastern Africa | 329,844,874 | 9,386,240 | 35.1:1 |

| Western Africa | 411,861,045 | 8,965,632 | 45.9:1 |

| Central Africa | 155,948,855 | 1,404,160 | 111.1:1 |

| Indian Ocean | 32,235,370 | 12,376,320 | 2.6:1 |

Market Trends and Strategic Priorities

Africa’s IPv4 market faces mounting challenges as population growth outpaces resource availability. With the continent’s population expected to double by 2050 and IPv6 adoption lingering at just 2.19%, IPv4 prices are projected to climb by 5–10% annually. This underscores the urgent need for efficient IPv4 management and a stronger push toward IPv6 adoption.

Organizations holding unused IPv4 addresses in the AFRINIC region should consider monetizing these assets while prices remain competitive. Simultaneously, planning for IPv6 adoption will be critical to meeting future demand and ensuring scalability in an increasingly connected world.

sbb-itb-6a10492

Pros and Cons

Based on the regional insights shared earlier, here’s a breakdown of the advantages and challenges of each IPv4 market.

Северная АмерикаСеверная Америка stands out for its mature IPv4 market and high availability. However, this comes at a cost, with /24 block leasing prices ranging from $0.50 to $0.70 per month. The region’s strong demand, driven by tech companies and cloud providers, continues to push prices higher.

Европа offers a middle ground between accessibility and affordability. With RIPE NCC’s flexible transfer policies, leasing costs typically range between $0.45 and $0.65 per month. RIPE NCC also allows inter-RIR transfers with ARIN, APNIC, and LACNIC, giving organizations more sourcing options. These factors contribute to Europe maintaining consistent pricing, averaging $0.43 in 2024.

Азиатско-ТихоокеанскийАзиатско-Тихоокеанский faces unique challenges, including high demand and regulatory hurdles. Limited supply has driven prices up, with APNIC rates peaking at $0.83 in May. According to Paulius Judickas, VP of Strategic Alliances at IPXO:

"Между тем, APNIC установила премиальные ставки (достигнув максимума в 0,83 доллара в мае) из–за серьезных ограничений с поставками - несмотря на растущий спрос в Азиатско-Тихоокеанском регионе, политика реестров фактически запрещает большинству организаций монетизировать свои ресурсы, за исключением устаревшего пространства. Это привело к тому, что компании в регионах APNIC часто объявляют IP-адреса только для того, чтобы сохранить их как "используемые", вместо того чтобы монетизировать их за счет сдачи в аренду".

This regulatory environment forces companies to hold onto IPs rather than lease them, further tightening the market.

АфрикаАфрика offers the most cost-effective IPv4 options, with leasing prices between $0.30 and $0.45 per month. While the region benefits from surplus resources, strict conservation policies limit flexibility. Additionally, the lack of inter-RIR transfers and infrastructure challenges may impact service quality for global deployments.

| Регион | Monthly Lease Cost | Key Advantages | Primary Challenges |

|---|---|---|---|

| North America (ARIN) | $0.50–$0.70 | Established market, good availability | High leasing costs |

| Europe (RIPE NCC) | $0.45–$0.65 | Flexible policies, steady pricing | Rising demand could strain supply |

| Asia-Pacific (APNIC) | $0.60–$0.80 | Expanding digital market | High prices, strict regulatory barriers |

| Africa (AFRINIC) | $0.30–$0.45 | Affordable leasing costs, surplus | Limited infrastructure, no inter-RIR transfers |

These regional disparities highlight the importance of tailoring IPv4 strategies to specific market conditions. For organizations prioritizing immediate availability and established infrastructure, North America may justify the higher costs. Europe provides a balance of affordability and flexibility, making it a strong choice for cost-conscious businesses. In Asia-Pacific, companies must navigate premium pricing and regulatory hurdles, while Africa offers affordable resources but comes with its own set of limitations.

To help businesses manage IPv4 costs and strategies, V4 Capital PartnersПартнер V4 Capital specializes in IPv4 brokerage and investment, assisting organizations in maximizing their underutilized IPv4 assets across regions while navigating complex regulations.

As IPv4 scarcity becomes more pronounced, these regional differences are expected to grow, making a geographically informed approach essential for effective IPv4 resource planning.

Вывод

The pricing and market conditions for IPv4 addresses are heavily influenced by geography. The data highlights stark regional variations: Africa offers the lowest prices, while the Asia-Pacific region sees significantly higher costs due to limited supply and strict regulatory hurdles.

In North America, a well-established digital infrastructure contributes to higher pricing, whereas Europe benefits from more flexible transfer policies and competitive pricing structures, supported by strong inter-regional transfers. These differences across regions play a key role in shaping strategic decisions as market dynamics continue to evolve.

Recent trends point to a shift in IPv4 pricing. While prices steadily increased from 2015 through early 2024, more recent data shows a decline in block prices. For example, IPv4.Global reported that by December 2024, average monthly prices for blocks ranging from /17 to /24 fluctuated between $32 and $36, while larger blocks saw a sharp drop from over $50 per address to between $32 and $34 by the end of the year. This decline opens opportunities for buyers but presents challenges for sellers. Additionally, flexible leasing models are gaining traction, offering new ways to manage IPv4 resources.

For businesses operating in multiple regions, strategic planning is now more critical than ever. Companies need to evaluate their specific needs, factoring in geographic proximity for better latency, cost savings across regions, and compliance with regulatory requirements. As IPv6 adoption continues to grow – now surpassing 44% globally – and technologies like Network Address Translation (NAT) extend the utility of IPv4 (allowing one address to support an average of 7 devices), businesses must carefully balance immediate IPv4 demands with preparations for an IPv6-driven future.

The regional differences in IPv4 pricing are likely to persist and may even widen over time. This makes location-aware resource planning essential for maintaining cost-effective operations. By understanding these geographic dynamics, businesses can refine their IPv4 strategies – whether through leasing in lower-cost markets, leveraging inter-regional transfers, or working with brokers who specialize in navigating complex regulatory landscapes.

Часто задаваемые вопросы

How do regional policies affect IPv4 address pricing around the world?

Regional policies significantly influence the pricing of IPv4 addresses by shaping supply, demand, and overall market dynamics. In regions where Regional Internet Registries (RIRs) enforce strict allocation rules, IPv4 addresses are often harder to come by, which can push prices higher. Conversely, areas with more relaxed policies may enjoy lower costs due to a larger pool of available addresses.

Beyond policy, factors like geopolitical stability and local economic conditions also play a role. For instance, regions investing heavily in internet infrastructure often see increased demand for IPv4 addresses, which can drive up prices. For businesses navigating the IPv4 marketplace, understanding these regional variations is crucial to making smarter, more strategic decisions.

How can businesses manage IPv4 costs effectively given regional price and availability differences?

To keep IPv4 costs in check, it’s important for businesses to stay informed about regional pricing differences. For instance, in North America, IPv4 leasing costs tend to be on the higher side, typically ranging from $0.50 to $0.70 per month per IP. In contrast, regions with lower demand, like parts of Latin America, often offer more affordable rates, usually between $0.35 and $0.50 per month per IP.

Another way to manage expenses is by leasing smaller IP blocks. These provide businesses with more flexibility and require a smaller upfront commitment compared to purchasing larger blocks. Opting for long-term leases can also reduce costs, as they often come with discounted rates, making them a smart choice for extended use.

Lastly, working with experienced IPv4 brokers, such as V4 Capital PartnersПартнер V4 Capital, can simplify the process. They can help businesses navigate regional market dynamics, secure competitive deals, and ensure they get the most value from their IPv4 investments.

Why are IPv4 prices higher in the Asia-Pacific region, and what does this mean for businesses there?

IPv4 Prices in the Asia-Pacific Region

In the Asia-Pacific region, the cost of IPv4 addresses has surged due to a mix of high demand и limited availability. As IPv4 addresses become scarcer, the rapid pace of digital expansion in this region has pushed demand – and prices – even higher. Adding to the challenge is the slow adoption of IPv6, leaving many businesses reliant on IPv4 resources.

For businesses in this region, these rising costs can strain budgets and complicate long-term strategies. To navigate this, companies might consider options like leasing IPv4 addresses or speeding up their transition to IPv6. These steps can help ensure reliable connectivity and maintain a competitive edge in an increasingly constrained market.